So many people make New Year resolutions with the intention of seeing them through. It gets to the end of January, though, and those resolutions are often forgotten. The motivation of a new start for the New Year is gone. There’s always next year, right?

Why should you wait until next year? There are ways to help you stick to your New Year resolutions. It doesn’t matter if you’re trying to lose weight, save money, or have business resolutions. Here are 5 tips to do just that.

1. Make Your Resolutions More Detailed

The problem with resolutions is that they can be too general. Have you ever said, “I want to lose weight this year,” or, “This year I’m going to save more money”?

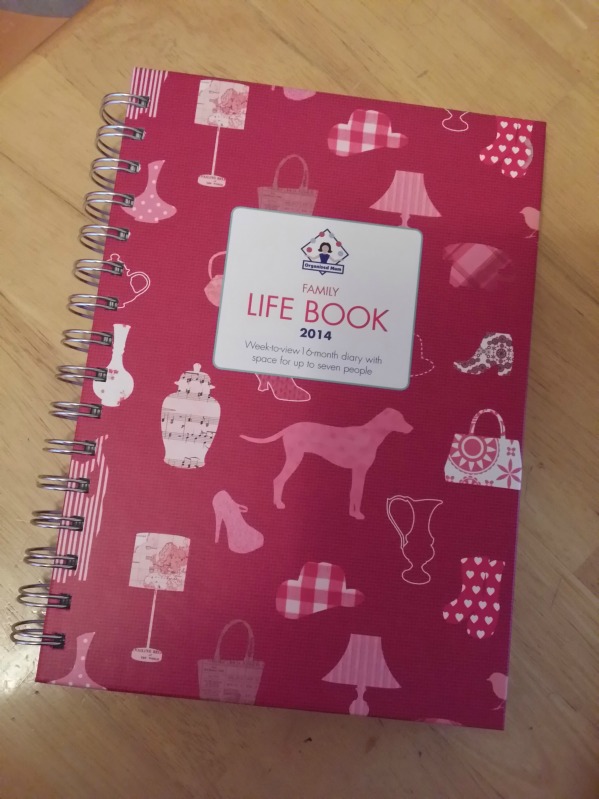

While that may be your general goal, it doesn’t give you the motivation to keep going later on. It also causes a problem when it comes to planning to meet your resolutions. So, you need to get more detailed into that resolution. Pull out a diary, a notebook, or even a sheet of paper to make a mind map and spend some time really thinking about that goal.

If you want to lose weight, think about the amount of weight you want to lose. This doesn’t need to be an exact number. It could be a dress that you want to fit back into, or to get to a healthy BMI.

When it comes to saving money, think about the final amount that you want to see at the end of 2014. What are you saving for? Do you want different amounts for different needs? Be specific!

2. Set Mini Goals to Meet Along the Way

That big goal can seem like a long way away. After all, it’s 12 months until the end of the year! It’s easy to lose sight as you go through the year, and you may give up on your New Year resolution. This is why mini goals are so important.

When I set the resolution to get to a healthy BMI last year, I had mini goals along the way. I noted each seven pound mark, then 5% of my starting weight, 10% of my starting weight, and finally the healthy BMI amount. This gave me something to aim for in short bursts. I felt more motivated because there was always something within reach. Some of these goals would take a month or so to get to, but others were just one or two pounds away, depending on where the 5% and 10% goals fell.

When you set mini goals, the bigger goal creeps up without you realizing it. While it’s in the back of your mind, there’s no the major focus on it because you’re constantly reaching for a target. But you know you’re going to reach that bigger goal, as long as you stay on track to meet the smaller goals.

I managed to reach my healthy BMI much sooner than I thought I would thanks to the smaller goals. In fact, I got all the way to my goal weight by the end of 2013 with mini goals along the way.

3. Celebrate Reaching Milestones

Whenever you reach a mini goal along the way, don’t forget to celebrate it. It makes you acknowledge the accomplishment so that you feel proud for sticking to the plan and getting your target. You will have the motivation to keep going until you reach your New Year resolution.

I celebrated every single pound I lost last year. I did that by moving £1 sterling for every 1lb in weight that I lost. It all went into a piggy bank, and I kept it until I reached my goal weight. It meant I could buy a new dress in time for the Christmas and New Year celebrations. It was great walking in to spend the money that reflected the amount of weight I lost.

There are many different ways to celebrate reaching targets. Going out for dinner is one of them, but you could book a holiday or mini break, or buy a new book to read. Find something that you enjoy that will mark this accomplishment. As you go along, you can even plan ahead for the next thing that you will buy. It makes that next target something you really want to reach because you want to buy your celebratory item.

4. Set a Plan to Achieve Your Goals

There’s no point having any goals or a detailed resolution if you’re not going to plan. Planning will help you work out how you’re going to get from where you are now to where you want to be at the end of the year. Going back to the money saving example from point one, you need to work out how you’re going to save your income for your goals. Say you want to save for emergencies and have a holiday fund. You will need to break down your budget and work out the money you have available to spend. From there, you can plan how that money is going to be divided into those two saving pots.

Avoid planning too far into the future. You never know when life will get in the way—and it will—or when something will change. I prefer planning month by month. I have more of an idea of what is going to happen between the first and end of each month. Some people prefer weekly plans, especially when it comes to meal ideas or business goals.

5. Make Yourself Accountable by Telling People

Tell someone close to you that you’ve set a New Year resolution. This makes you accountable and more likely to stick to it. You could even ask them to keep you accountable by asking you how you’re doing along the way. You never know; there may be someone else who wants to reach the same goals as you, and you can keep each other accountable.

If there isn’t someone you trust, you could keep yourself accountable anonymously online. Set up a blog and write about your New Year plan. If you’re not comfortable sharing information with strangers, you could write it in a diary instead. The best thing about writing everything down is that you get your feelings out there. You share your thoughts, the ups and downs, and achievements along the way. When you hit a rocky patch—and you will—you can look back and remind yourself just how far you’ve come.

Don’t just make your New Year resolutions and forget about them. Keep yourself accountable, plan ahead, and create mini goals., and make yourself proud at the end of 2014. Good luck!

Ready to begin your accountability now? Share your resolution below!